If you are already helping an aging parent with their financial affairs, the question might have already crossed your mind, “should I open a joint bank account with an aging parent?”

This may seem like the obvious thing to do as it could be quite convenient – for example, you could use it to pay for both your and your parent’s household bills, medical and prescription fees, or grocery shopping – but, sharing a bank account with your mom or dad can have its downsides as well.

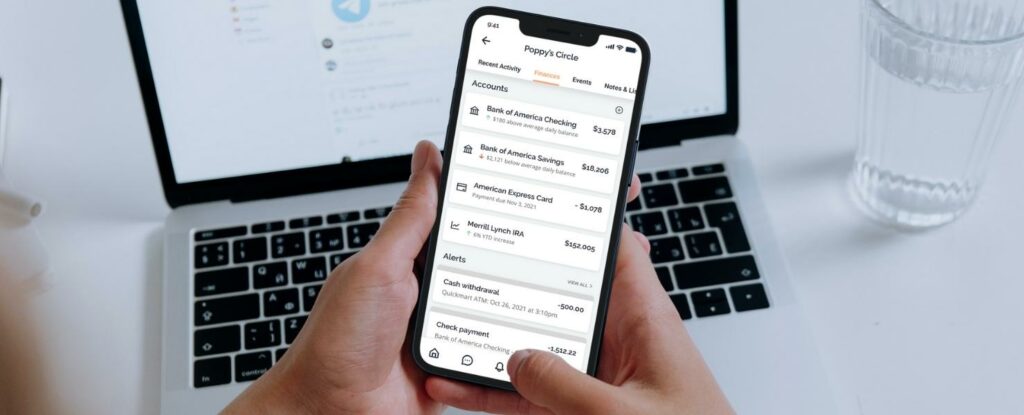

Whatever direction you choose, monitoring your parent’s finances as they age is critical to keeping them safe from scams, fraud, and exploitation, allowing them to live independently. Whether or not a joint bank account is the right choice, be sure to connect on a platform like WayWiser in order to monitor your parents’ finances as they age.

In this article we’ll run through the pros and cons of having a joint bank account with an aging parent and finish up with a few FAQ’s along with advice on how to approach your parents about their finances.

Joint Bank Accounts 101

What does it mean to have a joint bank account with one of your parents? Basically, it means that both of you own the account and the money it contains. There are two ways you can share a bank account with your mom or dad:

- You become an addition: If your parent already has a suitable bank account, they can add you as a joint owner.

- You open a new account: If no suitable account exists, or your parent wants to separate some of their funds, you can open a new joint account.

Joint bank accounts work pretty much like any other checking account.

There are two types of joint accounts:

- Joint checking: They enable you to use a debit card or write checks, make purchases, or pay bills.

- Joint savings: They enable you to keep a large amount of money safe and earn interest.

A joint account differs from a regular account in that it allows both people who own the account to have full control over it. This means that both you and your parent can use the debit card, write checks, and withdraw money as needed. You and your parent can also add money to the account. The bank makes no distinction between money withdrawn or deposited by you or your parent.

It’s important to understand that even if you have access to a shared bank account, your parents do as well. This means it’s just as important to keep an eye on things as if they had their own account as cognitive decline can quickly lead to financial troubles.

Advantages of a Joint Bank Account with an Older Parent

When you’re taking care of an aging parent and helping them to manage their finances, having a joint checking account can be helpful in the following ways:

- Pay bills: Sharing an account allows you to make sure that your parent’s bills are paid on time. You can even set up automatic payments.

- Oversee finances: If you monitor your parent’s account, you can make sure that they do not become a victim of fraud or identity theft. If you are concerned about their state of mind, you can also make sure they don’t overspend.

- Pay for medical care: If your parent needs emergency medical care, you can access money from the joint account to pay for it.

- Pay caregivers: If you are having to pay aids or caregivers on a regular basis, sharing a joint account can make this easier.

- Access to funds after bereavement: If you and your parent have a joint bank account, you can access their funds after they have died, without having to go through probate. This will make it easier when paying for funeral expenses, outstanding bills, and medical expenses.

Disadvantages of a Joint Bank Account

There are some negative aspects to having a joint bank account with a parent. Here are some of them:

- Financial risk: If you are having financial difficulties and you owe money you could be putting your parent’s money at risk. In many cases, creditors can take money from your joint account to cover your debts. (Read more about inheriting debt here)

- Eligibility risk: The money in the joint account could affect certain types of eligibility for your parent or your family members. For example, if you withdraw money from the joint account, it could affect your parent’s eligibility for Medicaid. If you have a child who is applying for college financial aid, the balance of the joint account may affect their eligibility.

- Tax complications: If you have a joint savings account and it is earning interest, both you and your parent will need to report this on your federal income tax returns.

- Family resentment: When your parent dies, all the money in the joint account belongs to you. This may cause problems if you have siblings. To avoid this, perhaps consider speaking to your parents about creating a trust. Learn everything about trusts.

Helpful Alternatives to a Joint Bank Account

There are alternatives to a joint bank account that may be more suitable for you and your parent at this time. These include:

- WayWiser: WayWiser is an app that allows you to connect with your family, close friends, or even paid caregivers in order to communicate and coordinate when it comes to the care of your aging parents. In addition to their shared calendar or notes & lists features, WayWiser provides financial monitoring and even document storage for important paperwork.

- View-only access: Depending on the bank, your parent may be able to give you a view-only option to their personal bank account. This will allow you to keep a check on the money going into and coming out of the account, without allowing you direct access to the funds. With this in place, you may also be able to opt-in for alerts should the balance of your parent’s account drops below a certain level, for example.

- Signature authority: Your parent can make you an authorized signer on the bank account without making you a joint account owner. This means you will be able to make certain financial transactions on your parent’s behalf. Your parent can decide which transactions they want you to have authority over.

- A convenience account: Convenience accounts are a popular option for people who wish to help an elderly parent with their finances. The account holder (your parent) can add you to the account. This allows you to withdraw money, pay bills, and write checks. With a convenience account, after the death of the parent, the funds in the account pass to the estate rather than to the other person on the account.

- Power of Attorney: If your parent grants you the right of power of attorney, this will allow you to make not only financial transactions for them but also financial decisions. For this to happen, you and your parent will need to meet with an elder law attorney or an estate planning attorney. They will draft the legal document for you and your parent must sign it. Your parent must also notify all their relevant financial institutions of this change. From then on you can manage your parent’s money and must do so in a way that is beneficial for them.

Frequently Asked Questions About Joint Bank Accounts

Can a joint account be shared by more than two people?

Yes, a joint account can be shared by more than two people. All of them will be responsible for any transactions made or fees incurred.

Is it difficult to open a joint account?

Opening a joint account is very similar to opening a regular account for one individual. When opening a joint account, both parties must provide identification such as a state ID, driver’s license, or passport as well as SSN.

What happens to the joint account if my parent dies?

If your parent dies, you will remain the sole owner of the bank account. You will still have access to the fund in the account and be responsible for any fees incurred.

How do I close a joint bank account?

Before closing your joint account you must stop all automatic transfers and withdrawals, such as debits for bills. Once the account balance is zero, you can notify your bank that you wish to close the account and they will instruct you on how to proceed to close the account permanently.

How to Talk to an Elderly Parent About Finances

Many people feel uncomfortable about approaching the subject of finances with their elderly parents. But it’s a good idea to plan for the future as soon as possible, particularly if your parent is in the early stages of Alzheimer’s or dementia. Here are some tips to help make the discussion a little easier:

- Take your time: There’s no need to dive headlong into the conversation all at once. Bring up the topic gradually. Mention aspects of financial assistance several times over a few weeks, or even months, so that your parent with feel at ease and under no pressure. Sow the seeds and give them time to mull them over.

- Pick the right time: Choose the right time to broach the subject. For example, a relaxing afternoon lunch is more ideal than a family gathering. You need to ensure that your parent is comfortable talking about their finances and how you can help them manage their funds.

- Pick a family member: If you have siblings, the best approach may be to assign the task to the one who has the best relationship with your parent. If you are all close, it may be something you want to do together.

- Focus on the benefits: When discussing your parent’s finances, and particularly the idea of a joint bank account, emphasizes the benefits such as how it will make their life easier, how you can help protect them from fraud, and ensure all their bills are paid on time.

- Get expert advice: In some cases, it may be easier to set up a meeting with a professional financial adviser or estate planner. This is a good way for you and your parent to get all the answers you need about managing your parent’s finances safely. Your parent is also likely to listen carefully to a professional’s advice. They will also have an opportunity to ask any questions they may have.

Moving Forward

Now that you are aware of all the pros and cons, you’re in a much better position to decide whether sharing a bank account is right for you and your parent if you are helping to oversee their finances. No situation is right for everyone, so it’s worth taking the time to consider your options and see how you can make them fit you and your family.