Summary: If you’re lacking time to read this article through, here are the bullet points:

- Cryptocurrency is a digital monetary system built upon blockchain technology.

- Blockchain is a decentralized, transparent, immutable, and secure technology that works by using smart contracts confirmed by users.

- Mining Pools are teams of people who combine their computing power to increase their chances of earning rewards for verifying transactions on a blockchain network.

- Liquidity Pools are methods of funding decentralized finance (DeFi) systems. Think of it as individuals backing a crypto “bank” opposed to the Federal Government backing a traditional bank.

- If you’re unfamiliar with liquidity pools or mining pools, you shouldn’t get involved as they are highly speculative and very often fraudulent. Liquidity pool scams and mining pool scams are prevalent.

- Scammers often create fake links, fake websites, and fake liquidity pools in order to gain full access to your crypto wallet by using hidden code.

- You should never do business with someone who you’ve never met in real life, and even then, you should be skeptical if you don’t fully understand the opportunity.

- You should never send money to get money—If you are asked for more money in order to get your money out of an investment, it’s a scam.

- If you realize that you’ve been taken advantage of and contributed money to a fraudulent liquidity pool, attempt to get your money out as quickly as possible and send it to a different wallet. If you can’t get the money, it is likely already gone. Count your losses, do not contribute any more money, and report the scam to the authorities.

An Introduction to All Things Cryptocurrency

Cryptocurrency. Blockchain. Bitcoin. Ethereum. Decentralized Finance. Mining Pools. Liquidity Pools. Smart Contracts. These terms have become part of modern vernacular, yet few people on the planet sincerely understand what they mean or how they work. To most of us, they sound like a mangled blend of tech jargon, investment opportunities, and potential scams.

This is nothing new. As innovative technologies introduce themselves to the world, it opens up unheard of opportunities for human advancement in business, medicine, finance, transportation, housing, food, and beyond. Solar energy, the internet, plant-based meat alternatives, the world is brimming with revolutionary ideas every day. It’s amazing and exciting!

However, like with anything new, there are only a handful of people who fully understand how these new technologies work. There are plenty who can throw the terms around in casual conversation, there are folks who will make grand claims about the money that they made on an early investment (though most of them are exaggerating), and there are even some who could give you a pretty decent layout of the way the technology works.

But the number of people who understand something like cryptocurrency or blockchain all the way down to the core, those who can look at the code and tell you what is happening and why it is happening, is frighteningly low.

This is why cryptocurrency, and in particular, liquidity pools and mining pools, have become fraught with scams. They prey on people who’ve heard the terms, feel as if they may have missed the boat when it comes to investing, and don’t really know enough about the concept to make an informed decision.

In this article we’re going to do our best to break down cryptocurrency, decentralized finance, liquidity pools, and beyond. We’ll provide simple examples of how they, and their components work. We’ll then go on a deep dive together to better understand how scammers are abusing these complex, yet legitimate systems to steal millions of dollars from unsuspecting citizens.

Our goal is to leave you more informed so that you can use these technologies to your advantage as they slowly creep into our daily lives and stay clear of the frauds and scams that plague the system.

There is a lot of information within, so feel free to skip ahead if you already know the basics.

- What is Blockchain?

- Smart Contracts vs Traditional Financial Contracts

- What is Cryptocurrency?

- What is a Mining Pool?

- What is DeFi (Decentralized Finance)?

- What is a Liquidity Pool?

- Example of How A Liquidity Pool Works

- What Does It Mean To “Stake Your Tokens”?

- Cryptocurrency Scams

- Liquidity Pool Scams

- 7 Common Liquidity Pool Scams

- Liquidity Pool Scams – Real Life Examples

- Recovery Scams

- What To Do If You’re The Victim of a Liquidity Pool or Mining Pool Scam

- Quick Tips to Avoid Cryptocurrency Scams

Getting Started – The Building Blocks

While you may be reading this because you want to understand more about liquidity pools, you need to have a basic understanding of how cryptocurrency works and a few other dynamics of the system as a whole before you dive into the deep end.

The technology behind decentralized financial systems is astronomically complex. However, like with driving a car, you don’t need to have the skill set to build an internal combustion engine from scratch to get behind the wheel, but you do need to understand how the pedals, steering wheel, and windshield wipers work.

Take this as your crash course in the wild world of cryptocurrency. We’ll break it down to be as digestible as possible.

What is Blockchain?

This is the foundation. You may have heard the term before. Perhaps you thought it was interchangeable with cryptocurrency. Perhaps you knew that it was the technological fabric on which cryptocurrency was engineered. Perhaps the term is brand new to you. Either way, it’s always good to get a bit of a refresh.

For fun, we’re going to include some knowledge from ChatGPT—an AI interface—because why not allow a computer to teach us about computers?

According to ChatGPT, in the simplest of terms, “Blockchain is a decentralized, digital ledger that records transactions on multiple computers in a secure and transparent manner. Each block in the chain contains a record of multiple transactions and once recorded, the data in a block cannot be altered. This makes the technology highly secure and resistant to tampering, fraud and hacking.”

Okay, so what does this mean?

What you need to know is that a blockchain differs from traditional computing in several, potentially beneficial ways:

- It is decentralized. The information is spread across a network of computers rather than living on one single database in a warehouse somewhere in the desert that can be hacked.

- Information on a blockchain is transparent. As long as you know how to read the code, it is right there for your viewing. No secrets allowed!

- The data is unchangeable. Once the information has been placed into a “block”, it is permanent. Lock it up and throw away the key.

- It is secure. Because of the algorithms used for data confirmation and through the decentralized nature of a blockchain, the information on a blockchain is practically unhackable.

- It is trustworthy. Since independent users need to verify all data that is added to a blockchain, the information is trustworthy.

Still scratching your head a bit? That’s okay.

Making it a bit more visual, you can think of blockchain as a train. Only, instead of railroad cars, you have blocks of code. When data is created and added into one of the cars (like a shovel full of coal), dozens of other people need to verify exactly what is being added into the car. In fact, imagine that every piece of coal added needs to be confirmed by an independent source. Once every piece of coal is confirmed by a few others and there is a mutual understanding of what is being placed into the train car, it is locked up forever inside of a train car, the key destroyed, and sent on its way. Now we’ll fill up the next car on the train.

Hopefully you can see how doing something like this in the physical world would create a decentralized, transparent, unchangeable, secure and trustworthy system. Nobody would be able to sneak a diamond into a pile of coal because you can’t add anything without it being publicly verified. And nobody would be able to steal any of the coal because nobody has the key. In the absolutely simplest sense of the word, this is how a blockchain works.

Smart Contracts vs Traditional Financial Contracts

There are two reasons that a blockchain is the perfect place for cryptocurrency to exist. One we just learned about—a blockchain is decentralized, transparent, unchangeable, secure, and trustworthy. If CryptoCoinX is placed into the blockchain, it can’t be changed, just like a dollar bill in your pocket. The trade value may alter over time with inflation, but 100 years from now, just like a dollar bill in your pocket, you’ll have that same CryptoCoinX.

The second reason that blockchain is the perfect place for cryptocurrency to exist is the concept of a “smart contract”.

According to our good friend, ChatGPT, in the simplest of terms, “A smart contract is a self-executing contract with the terms of the agreement between buyer and seller being directly written into lines of code. The code and the agreements contained therein exist on a blockchain network, making the contract secure, transparent, and verifiable. When the specified conditions are met, the contract automatically executes itself without the need for intermediaries. This allows for secure, automated transactions without the need for intermediaries and reduces the risk of fraud and human error.”

So what does this mean? How does a smart contract compare with a more traditional contract?

It’s relatively simple when compared to a traditional contract.

Think about the age old paper contract that you might make between you and a bank when you’re looking to secure a loan. Even if you sign some things digitally these days, it’s still, fundamentally a paper contract.

On a traditional contract, a few words are written on a page and you and the banker will both sign that paper, shake hands, and agree to the terms. Now that paper needs to be physically processed by a few other people at the bank which can take days if not weeks. And if there are ever questions about what some of the words mean, a lawyer needs to come to the scene and help interpret the contract. And if $100 falls on the floor when the loan is being delivered, or if the delivery is interrupted by a thief, you may spend the rest of your life trying to recover the missing funds.

With a smart contract, on the other hand, everything is handled transparently, automatically, and securely. The agreement is made—I will give you $100 USD in exchange for 1 CryptoCoin—and everything from there on happens with essentially no delays and no possibility of error or thievery.

What is Cryptocurrency?

Now that you understand blockchain and smart contracts, you can understand the basics of cryptocurrency.

In a nutshell, cryptocurrency is a digital currency that operates independently from a central, government backed bank. It is built on blockchain technology—making it decentralized, transparent, unchangeable, trustworthy, and secure—and it uses smart contracts to ensure that peer to peer interactions can be immediate, transparent, and similarly secure.

Simple enough at the outset, but a bit more complicated when you try to understand how these virtual “coins” come into existence and maintain value.

The most notable cryptocurrency available is Bitcoin, so we’ll use that as an example since it is a relatively prototypical example of the concept.

Bitcoin was built with the simple intention of removing our dependence on a centralized financial system. It was developed so that users could have financial freedom and privacy.

So how does it work, exactly?

Well it’s all about the smart contracts and the transparent and immutable chain.

You’ve probably heard the term “mining” at some point when referring to cryptocurrency. This term likely came as a reference to the days when people would need to head towards uncharted territories and quite literally mine for gold. They had to put in hard work for their king and country and were rewarded with a small sum at the end of the day while the majority of their efforts went towards funding societal infrastructure (or an aloof royal family).

For cryptocurrencies like Bitcoin, mining is the process of solving complex puzzles associated with transactions. It’s the part of the blockchain that makes smart contracts transparent and secure. For any transaction that takes place on a blockchain, complex mathematical problems need to be worked out in order to validate the contract. Once solved, they are added to the chain, never to be removed or changed. They become part of the structure of the blockchain.

In exchange for solving these puzzles, like those who would physically mine for gold, the owner of the computer who comes to the resolution fastest is awarded a small amount of cryptocurrency as a reward associated with the amount of work involved.

For a cryptocurrency like Bitcoin, there is a limit to how much is available, similar to a precious gem or gold. Bitcoin’s threshold is 21 million coins, as was determined by its creator from the outset, and will likely reach its threshold around the year 2140. At that point, rather than being rewarded with bitcoin, miners will be working for transaction fees.

There are hundreds of types of cryptocurrencies available these days and they aren’t all exactly the same, but the popular ones mainly run by these same principles. They are built on blockchains that are set up to solve complex computing puzzles, thereby validating transactions, and those who help solve these puzzles are gifted virtual currency as a reward.

You should be aware, however, that not all cryptocurrency is the same. There are many coins that are considered “meme” coins, like the popular Dogecoin, and these tend to be built more around having fun with the technology than building a scalable, investable platform.

What is a Mining Pool?

We referenced crypto mining above and compared it to actual mining in a cave for gold or gems. Similarly, you can think of a mining pool as a collection of people who get together so that their combined computing power is stronger. Just like a group of people organizing so that they could dig a larger pit and find more gold, a crypto mining pool is a group of people organizing their computers in order to solve more complex puzzles and sharing the rewards.

Typically, as a blockchain progresses and grows larger, the computing power needed to verify the smart contracts becomes greater and greater. For this reason, the need to combine computing power has become important. However, mining pools have also become rife with scammers looking to take advantage of people who don’t understand what they are doing.

What is DeFi (Decentralized Finance)?

In a way, a DeFi (the shortened term for Decentralized Finance) system is an extension of the cryptocurrency ecosystem. Typically built using smart contracts on Ethereum’s blockchain technology, a DeFi platform is a system that allows peer to peer transactions on a transparent, immutable, secure ledger.

One way to think of DeFi is a smart bank or a home for smart contracts and secure monetary exchanges. Typically they are even built around so-called “stablecoins” which are essentially digital versions of something like the US dollar. The most common stable coins are Tether (USDT) and the United States Dollar Coin (USDC). If you get involved with a DeFi liquidity pool (see below) it’s likely that you’d be trading USDT or USDC for another coin.

Using a DeFi system, you could create a contract as simple as, let’s say, “if Lebron James wins MVP, I will pay you $100” or something more complex like a series of stock market options or even insurance contracts.

Once the contracts are created and verified, the code can be viewed by anyone, they can never be changed, and they’ll be transacted immediately when the terms are reached.

The final piece of the DeFi puzzle that differentiates it from a traditional financial system is the liquidity pool. So let’s get to that.

What Is A Liquidity Pool?

A liquidity pool, at times referred to as a liquidity mining pool, is what allows a DeFi system to operate. A traditional bank is backed by major investors and the Federal Deposit Insurance Corporation (FDIC). If you need to borrow money or if you want to withdraw your savings at any given time, they are backed by institutional capital, allowing them to make these transactions without issue (at least for the most part).

A DeFi system, on the other hand, is decentralized. Rather than being funded by a core administrative power, it is funded by a network of users. This is the liquidity pool. It is quite literally a pooling of money at a certain valuation (i.e. $100 for 1 CryptoCoin) that allows the DeFi system to have the necessary liquidity to allow for financial transactions. Users contribute their cryptocurrency to the liquidity pool in exchange for rewards, often in the shape of a coin unique to that particular DeFi system.

Sometimes it’s easier to consider tangible items over technology, so let’s consider a quick metaphor. If Susan has 50 oranges and wants to trade them for 100 apples (assuming an orange is worth 2 apples on the open market), then she’ll head over to the Farmers Market Exchange. Luckily, the Farmers Market Exchange has had a number of their members contribute apples and oranges to their stockpile, or pool, at the valuation of 1 orange = 2 apples, so when Susan walks up to the table, they can write a contract and give her those 100 apples. Maybe 30 come from John and 100 from Lisa, and 70 that were contributed by a group of 20 other backyard farmers who just contribute a few pieces of fruit each.

If the Farmers Market Exchange didn’t have members contributing apples and oranges based on that valuation, if they didn’t have a pool full of fruit, they wouldn’t be able to handle the transaction and would essentially be rendered useless. This is why, knowing that they need to have apples on hand, in exchange for their contributions, John, and Lisa, and those backyard farmers were all given a small reward in the form of Farmers Market tickets that can be used to trade for other things at the Farmers Market Exchange. Of course, those tickets have an inherent value themselves and the apple contributors might decide to just hold onto them and see if they go up in value over time.

The hope is that by contributing my oranges and apples to the pool in exchange for some Farmers Market tickets, one day I’ll be rich with Farmers Market tickets and I can trade those for whatever I want.

A liquidity pool is pretty much like that.

Example of How A Liquidity Pool Works (According to ChatGPT)

Here is how ChatGPT explains a liquidity pool.

Let’s say a DeFi platform called “TradeX” wants to increase the liquidity of its trading pairs (e.g. ETH/USDC, BTC/USDT). To achieve this, TradeX creates a liquidity pool for each trading pair, and users can deposit assets (e.g. ETH, BTC, USDC, USDT) into these pools. Once assets are deposited, users are considered liquidity providers, and they will earn rewards in the form of TradeX tokens.

As an example, let’s say Alice wants to participate in liquidity mining on TradeX. She deposits 1 ETH and 100 USDC into the ETH/USDC liquidity pool. Now, as long as Alice keeps her assets in the pool, she will earn TradeX tokens as a reward for providing liquidity to the platform. The amount of rewards she earns is determined by the amount of assets she has deposited, the duration of time she keeps them in the pool, and the overall trading activity in the pool.

In this way, liquidity mining incentivizes users to hold and trade assets on the platform, which can help to increase the platform’s overall liquidity and make it more attractive to other users.

What Does It Mean To “Stake Your Tokens”?

There are quite a few idiosyncrasies to understand with DeFi systems and liquidity pools, but the last one that we want to cover in the hopes that you can make wise decisions and stay away from liquidity pool scams is the concept of staking tokens.

Staking tokens is similar to a Certificate of Deposit (CD) in the traditional banking system.

If you aren’t familiar with CD’s, it’s essentially a savings account where you’ll get a higher rate of return, but you aren’t allowed to take your money out for a certain period of time, essentially locking it up. This allows a bank to make money with your money by loaning it out for a high interest rate, ideally bringing in more than they would owe you at the end of the term.

Staking tokens is similar. An individual would add cryptocurrency to a liquidity pool via a smart contract, and as part of the contract, they wouldn’t be able to take their cryptocurrency back out.

Here is an example of how staking works, again according to ChatGPT:

Let’s say a DeFi platform called “TradeX” has a liquidity pool for the trading pair ETH/USDC. Alice wants to stake her tokens in the pool, so she sends 1 ETH and 100 USDC to the pool’s smart contract. Once the tokens are received, Alice is now a liquidity provider for the pool and is entitled to a share of the rewards generated by the pool.

The rewards are distributed according to the proportion of the total pool assets that the user stakes. For example, if Alice stakes 1 ETH and 100 USDC, and the total pool assets are 10 ETH and 1000 USDC, Alice is entitled to 10% of the rewards generated by the pool.

It’s important to note that staking tokens in a liquidity pool also means that the user cannot access those tokens for a certain period of time, which is determined by the smart contract, and usually it is called lock-up period.

By staking their tokens in a liquidity pool, users are helping to increase the platform’s overall liquidity and can earn rewards in return, which can help to offset the opportunity cost of locking up their assets.

Cryptocurrency Scams

So, why does this lead to so many scams?

There is a relatively simple answer and it goes back to our introduction to the entire topic. When you have a technology that few people understand, it’s easy for bad actors who do understand it to take advantage of the rest of us. That’s especially true when people see big dollar opportunities and can fear that they are missing out on something great.

As you can probably imagine, even if you do know what you’re doing, this is all risky business. Real money is being exchanged for novel cryptocurrencies that have no value beyond the belief in value and staked backing by others. There is no insurance, there are no institutional or governmental ties, and everything is being transacted on decentralized systems.

Sure, it’s transparent…but can you read the code?

Sure, it’s secure…but does that weigh in your favor or favor of potential scammers?

Sure, it can never be changed…but is that good for a new user who might make a costly mistake?

And, at the bottom line, none of this even matters as scammers often target people by setting them up on completely fake platforms, engineering the entire look and feel of investing when, in reality, they are just taking money from unsuspecting strangers and placing it into their own pockets.

Liquidity Pool Scams

As alluded to above, liquidity pool scams are not only common, but often based on intentionally misleading or even completely false information. They are targeted at people who aren’t very well versed in cryptocurrency or blockchain systems, preying on their ignorance of the system and their yearning to get involved and make money.

Think of joining a liquidity pool in the same way as any other complex investment or business deal that you might take part in. If it sounds too good to be true, it more than likely is! And worse yet, because of the unchangeable nature of smart contracts and the ease of faking things on the internet, it’s easy to fall into a trap without ever realizing it.

We all know that if you’re handed a complex legal document, it’s best to have a lawyer look it over as they are trained in spotting anything fishy. You should keep this same mindset when it comes to anything blockchain related. Nearly nobody on earth is an expert in cryptocurrency and DeFi systems. It isn’t expected for you to understand the ins and outs. That’s why it’s important to lean on experts, not just the advice of strangers.

Remember, smart contracts are both transparent and immutable. So, if you know what to look for, you can spot some code that doesn’t make sense, but if you don’t know what to look for, you can wind up held to a contract that allows the party who created the contract to essentially do whatever they please, or a contract that was never really a contract to begin with, just an elaborate ploy.

Plainly enough, it’s quite easy for a scammer to say, “all you need to do is scan this QR code and go through the steps and you’ll be all set up to earn incredible reward in this liquidity pool,” wherein reality, those steps could have you signing a contract that says something more like “you can apply your funds to this liquidity pool and also you give unlimited access to your crypto wallet to the owner of the liquidity pool,” or could just be a bunch of hogwash that makes you feel like you’ve entered into a contract when really you’re just being set up for some trickery.

If you’re curious about reading more about backdoors that can be set up within smart contracts, this article goes into pretty deep detail along with providing a few real world examples that take a look at the source code.

Legitimate or not, a DeFi system is extremely speculative and should be handled with caution even by those with intricate knowledge of the technology. And for those of us who aren’t well versed in the blockchain, it’s that much more frightening as there are myriad ways to fall victim to a cleverly placed trap.

7 Common Liquidity Pool Scams

Here we’ll quickly lay out a few of the many common liquidity pool scams. Afterward we’ll walk you through some real life examples of these play out.

- Exit Scams: This all too common scam is simple. Once the DeFi platform is flush with cryptocurrency that has been contributed by unsuspecting investors, the creators of the pool will suddenly withdraw all of the funds, leaving investors with worthless tokens and nothing more.

- Ponzi Schemes: You’ve probably heard the name Bernie Madoff as he conceived and led one of the largest ponzi schemes in history. While Madoff worked with traditional currency, the same concept exists within the crypto community. The operator of a DeFi exchange will promise investors a large return but instead of using the funds as intended, they use the new money to pay off old debts and so on until the scheme collapses and the operator disappears with the bank.

- Rug Pulls: A rug pull is when the creators of a liquidity pool withdraw their own funds from a pool (typically a very large sum) in one fell swoop, which would make the pool illiquid, leading to a sudden drop in the value of any tokens that have been earned. This allows the creators to get out with a fortune, leaving the investors with pennies. If you’re curious, this is a 2022 roundup of Rug Pulls.

- Fake Yield Farming: This is very similar to a ponzi scheme, but more specific to liquidity pools. It’s a situation where new liquidity providers (investors) are promised high returns, but the returns aren’t generated by the pool itself, but actually are funds taken from new investors. This can make things feel legitimate and quite significant for an early investor, showcasing how quickly someone can make money. It’s a gateway for the scammer to convince a potential investor to add more of their funds since they are seeing such great returns, but once those funds are at their peak, the pool creator takes the money and disappears.

- Phishing Scams: This is where a hacker would impersonate a legitimate liquidity pool or DeFi platform, but trick users into sending their funds to a fake website, address, or wallet. In this scam, you’re never even working with a liquidity or mining pool in the first place. You’re just interacting with fake links and sending money to fake places—similar to a phishing email that asks you to send money to a bogus address.

- Front-Running: This is similar to insider trading. It’s a situation where privileged users have access to information ahead of other users, allowing them to use that knowledge to generate profits for themselves at the expense of others.

- Liquidity Hijacking: Not a scam per se, but a situation that imperfect liquidity pools can lead to. This is when a malicious actor takes control of a liquidity pool by exploiting vulnerabilities in the code, using it for their own gain.

Liquidity Pool Scams – Real Life Examples

One of the most important things to understand about liquidity pool scams and mining pool scams is that they are prevalent. There is no reason to feel embarrassed if you were a victim. You are not alone. Sharing your story, like some of these people have done, will help others understand how the scams work and better understand how to spot a scam and stay safe.

Mining Pool Romance Scam

So, let’s jump to it and start with a video. This is a great example of how a scam can start from a potential online romance and quickly become something sinister.

Liquidity Pool Scam with Screenshots

In this article, the author runs through another liquidity pool scam, including screenshots and some understanding of what to look for from start to finish. His tips include:

- Checking on how old a social media account is, assuming you were contacted on a social media network like Twitter

- Looking out for someone quickly pushing you to create a Coinbase wallet and purchasing a stablecoin like Tether

- Being sent screenshots of legitimate apps that aren’t in English

- Being invited to Telegram or Whatsapp groups where they talk about big rewards

- Be aware of being asked to pay surprising fees for things like “blockchain certificates”

Liquidity Mining Pool Scam from Start to Finish

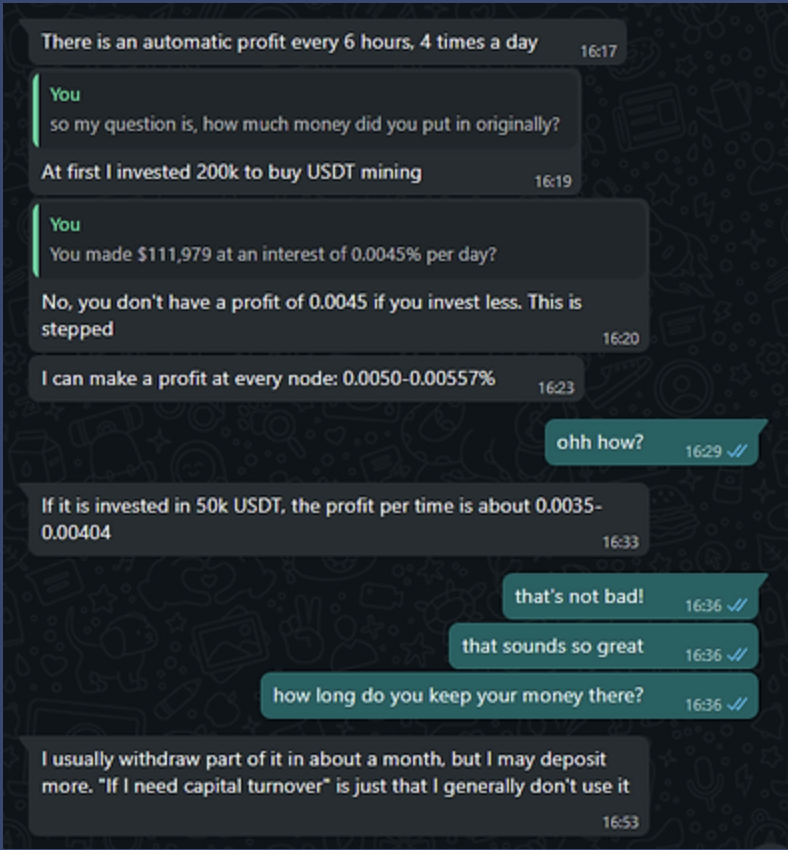

Here is another video that walks us through an entire scam from start to finish. Outside of the importance of understanding the steps that start on social media and end on cryptowallets, one key learning here is how the scammer literally gives the victim money—real money—as a means of gaining trust. They deposit a small amount of currency into your account to cover your initial fees, but what you don’t realize is that this is just a ploy to bring you into a smart contract that gives them unlimited access to your wallet.

The creator of this video also has a small blog post that includes screenshots of the conversations that he had with the scammers (like the one below). We strongly recommend taking a look so that you can understand the signs of a mining pool scam.

More Liquidity and Mining Pool Scams

The scams seem to be endless. The FBI has placed information out there for people to read, but for whatever reason, it hasn’t spread fast enough.

Here is a Reddit user asking about the members of the Coinbase subreddit if he’s being victimized or being offered an incredible payday.

Here is an entire subreddit dedicated to Ethereum mining scams.

This is a post from Coinbase themselves warning people of mining pool scams.

It truly seems like this is an epidemic that just isn’t hitting the front page of the news.

Recovery Scams

Thought it was over? Think again. Recovery scams are how these malicious individuals attempt to grab a few more dollars even on the way out.

If you catch wind that this might be a scam, or you simply decide you’re happy with your returns (which you’ll likely never get access to anyhow), and ask to leave the pool, the scammers will hit you with a recovery scam.

This is a simple, yet effective scam where the owner of the pool will tell you that they’ll gladly release you from your contracts and send your money back, they just need you to pay the fees involved in releasing the funds. Sometimes they will say its a tax, sometimes a transaction fee. Either way, it is not real.

These fees go directly into their pocket and the funds remain under their control, and can often be quite enormous if based on the amount of money that you think you are owed.

Be warned, a tell-tale sign of a scam is being asked to pay money in order to get money.

We recently saw the above video on CNN that portrays just how bad these recovery fees can hurt.

What To Do If You’re The Victim of a Liquidity Pool or Mining Pool Scam

All things said and done, it is not easy to recover. More than likely, what’s done is done and your best bet is to count your losses, report it to the FBI, cut ties with your cryptowallet, removing any currency that is still available, and do your best to hold your head high as you walk away from this as a learning experience.

The other thing that we’ll mention, before jumping into a possible recovery options to try, is that you shouldn’t be ashamed. You are a victim of a crime. It wasn’t your fault and you are not alone in this. If you lost a meaningful amount of money, don’t be scared to tell your family or friends so that they can help you as you figure out the best way forward. You’re already in a dark headspace and the best thing to do in that situation is to surround yourself with support.

If you do want to give things a try, you can read through this blog article on preventing scammers from draining what’s left of your crypto wallet.

The best thing that anyone points to in the research that we’ve done, is to work quickly and transfer any available funds from one wallet to another the moment that you suspect something is up. Even after universal control has been attained by a scammer, they might not do anything right away as they are still trying to convince you that this is real in order to have you supply more funds to your wallet. If you realize the situation fast enough, depending on the scam, there may be a way to pull your money out before it disappears, but this is not always the case.

After disconnected from any wallets or funds, just keep an eye on things as you move forward. Most likely, this is the end, but it’s important to be vigilant.

Quick Tips to Avoid Cryptocurrency Scams

Recovery can be tough if not impossible, so the best offense is, as they say, a great defense. Learning what to look for and how to prevent the situation is ultimately the greatest way to remain safe.

Here are some quick tips.

- Only risk money that you’re willing to lose. This is the age-old adage given to gamblers. If you put $1,000 on the roulette table, you better be willing to lose $1,000. The same goes for any investment that isn’t guaranteed. Just because you start seeing some big rewards up front, doesn’t mean you should throw your life savings at it because you just might lose it all—even if it is a legitimate investment!

- If you realize something is off, get out asap, disconnect, move on. The moment that something feels funny, do whatever you can to remove your funds. Don’t take time to think about it, if it winds up being legitimate, you an always get back in, but if it is a scam, you might miss the window to get out.

- Don’t trust strangers on the internet. Don’t trust strangers anywhere. If you start chatting to a random person on the internet, it should be an immediate red flag if they start talking to you about an investment opportunity. Why would they offer this information if it wasn’t somehow in their own best interest? The same goes for strangers in real life. A friend of a close friend who you meet at a dinner party, sure, that’s likely safe and they might just want to share a tip. But the guy who stands around at the food truck by your office? Likely not the best person to take financial advice from.

- Don’t overshare on social media. As a way to attempt to stay away from predatory scammers, keep your personal information off of social media sites. This is often where potential criminals are able to find just enough data to know how to creep into your life and seem like a friend.

- If it sounds too good to be true, it probably is. Another age-old adage. If you could make 5% compounding interest day after day, everyone would be doing it and everyone would be rich within a year. Word would have gotten out and spread like wildfire. If the opportunity sounds unreasonable, it very likely is.

- Look out for overly aggressive people. If someone hounds you to invest in their fund, if they start calling you dumb or crazy for being coy, there is a reason for their aggressive and hurried tone. They aren’t overly concerned that you aren’t getting rich. They are overly concerned that they aren’t getting rich themselves.

- You shouldn’t need to pay money to get money. If you’re asked to pay a significant fee in order to access your money, this should immediately raise a red flag. There might be a gas fee, which is essentially a bit of Ethereum that powers a transaction, similar to a service fee at a bank, but if you are told that you need to deposit $1,000 in order to then take that money and your current funds out, something is off.

- You can scan tokens, wallets, and more. Blockchains are built on transparency. If you’re a bit more technically savvy, you can use Etherscan.io to take a look at a token, a wallet, a domain, or a blockchain before doing business.

Wrapping Up

There is a lot to digest in this article, but hopefully you’ve come out the other side with a better understanding of how cryptocurrency, DeFi platforms, mining pools, and liquidity pools work and, perhaps more importantly, you understand how people use them to scam unsuspecting individuals.

The ultimate takeaway is that cryptocurrency and blockchain technology are very complex and confusing. Most people on the planet know little to nothing about it, yet they will often act as if they are experts.

It’s okay to be unsure or uncomfortable when it comes to these new technologies. If you are ever approached about making an investment in cryptocurrency in any manner, be it for a new coin, a liquidity pool, a mining pool, or something else, it’s best to reach out to a friend who might not a bit more about it and run it past them before contributing money.

Be aware of the scams out there and do your best to keep yourself safe. And, if you do fall victim to one of these malicious exploitations, don’t feel ashamed. Tell your family so that they can help you recover as quickly and safely as possible.